pay indiana state tax warrant

DOR offers customers several payment options including payment plans for liabilities over 100. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Couple Charged 10k For Taxes They Didn T Owe

Do not call the Hamilton County Sheriffs Office as this agency has nothing to.

. Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the Indiana Department of Revenue DOR. Office of Trial Court Technology. If your account reaches the warrant stage you must pay the total amount due or accept the.

Find Indiana tax forms. These taxes may be for individual income sales tax withholding. However circuit clerks using the INcite e-Tax Warrant application or.

Indiana State Tax Warrant Information. Pay online quickly and easily using your checking or savings. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Information about novel coronavirus COVID-19 INgov. To let us know that you would like to subscribe to e-Tax Warrant Search Services mail the completed User Agreement to. To request expungement on your Indiana state tax warrant submit State Form 56196 Expungement Request Form.

The Service this Tax Warrant Collection System provides is solely based on and reliant upon human and technical resources that are within the State of Indiana. An official website of the Indiana State Government. Occasionally it is necessary for the Indiana Department of Revenue DOR to issue bills for unpaid taxes.

The card owner may call 1-888-604-7888 to process the payment refer to Payment Location Code. How do I pay a tax warrant in Indiana. Know when I will receive my tax refund.

Payment by credit card. A tax warrant is equivalent to a civil judgment against you and protects New York States interests and priority in the collection of outstanding tax debt. Continue recording tax warrant judgments in the judgment docket if not received electronically see IC.

About Doxpop Tax Warrants. Doxpop provides access to over current and historical tax warrants in Indiana counties. Indiana County Sheriffs are required by State Statute to collect delinquent State Tax.

Know when I will receive my tax refund. Questions regarding your account may be forwarded to DOR at 317. Find Indiana tax forms.

You can make an Indiana tax warrant payment with an. If you are disputing the amount owed call the Department of Revenue at 317-232-2240. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional.

Here are your payment options. Our service is available 24 hours a day 7 days a week from any location. Taxpayers must complete the Expungement Request Form and submit any documentation that may support the request.

What is a tax warrant. Instead this is a chance.

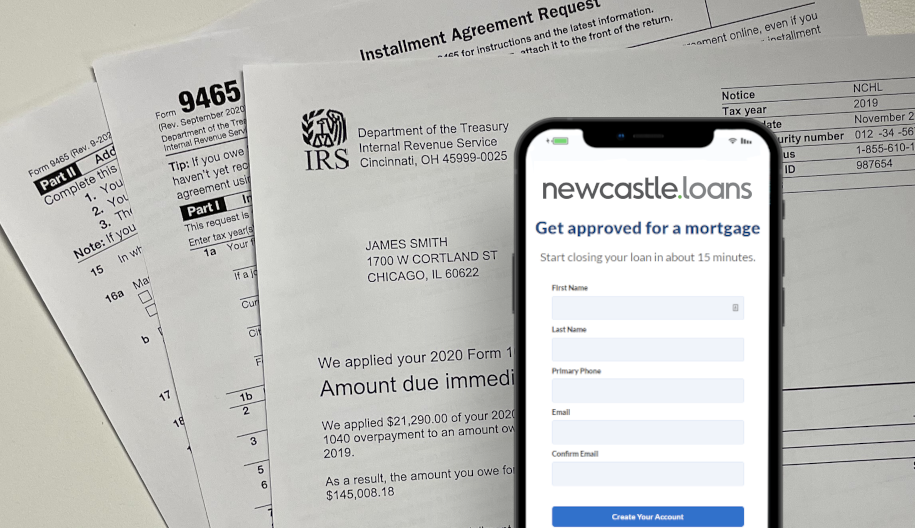

Can I Get A Mortgage If I Owe Federal Tax Debt To The Irs

How To Pay Indiana State Taxes Sapling

Indiana Bond Bank Indiana Bond Bank Returns Nearly 350 000 To 29 School Districts

Prepare Efile Your Indiana State Tax Return For 2021 In 2022

Indiana Tax Warrants System Atws

The Essential List Of Tax Lien Certificate States

What States Allow The Sale Of Tax Lien Certificates

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

Tax Lien States The Complete List Plus Advice

Can Indiana Issue A Warrant For Unpaid Taxes Levy Associates

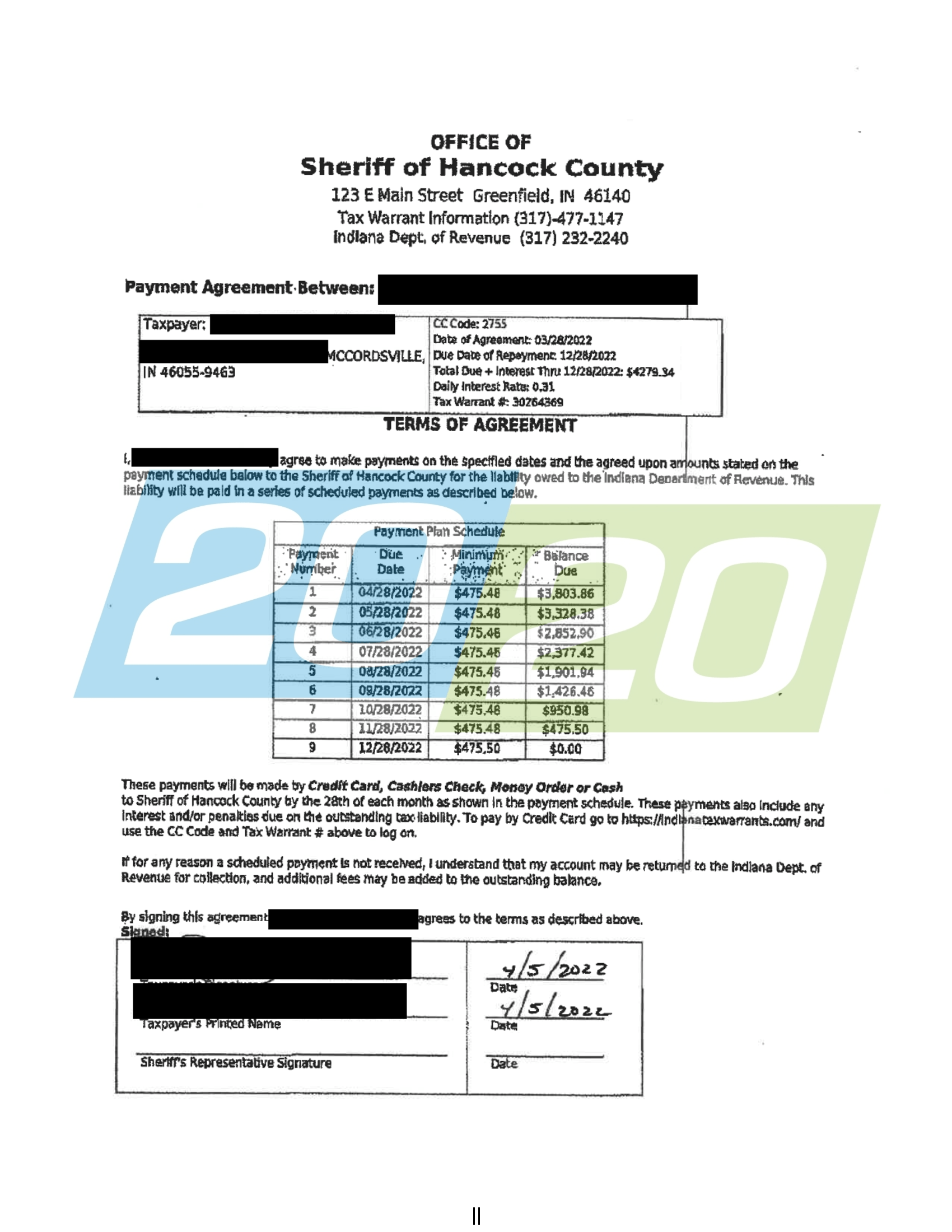

Real Tax Resolutions In Indiana 20 20 Tax Resolution

Owen County Indiana Tax Lien Tax Deed Sale Information

Indiana Mechanics Liens Everything You Need To Know To Get Paid Fast Free Forms

A Guide Through The Tax Deed States Are They Legal

Amazon Com How To Buy State Tax Lien Properties In Indiana Real Estate Get Tax Lien Certificates Tax Lien And Deed Homes For Sale In Indiana Ebook Mahoney Christian Kindle Store